Arizona offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

City of Phoenix Office of Sustainability

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Arizona Government

Office of the Governor

1700 W. Washington St.

Phoenix, AZ 85007

Phone: (602) 542-4331

Fax: (602) 542-7601

[email protected]

Hours: M-F 8:00am – 5:00pm

Arizona Public Service

400 North Fifth Street

Phoenix, AZ 85004

(602) 371-7171

Residential Service: [email protected]

Business Service: [email protected]

Hours: M-F 7:30am – 5:00pm

Arizona Governor’s Office of Resiliency

1700 W Washington St, Ste 500

Phoenix, AZ 85007

(602) 542-4331

[email protected]

Hours: M-F 8:00am – 5:00pm

Phoenix Weather Bureau

2727 E Washington St

NWS PAB 1TA

Phoenix, AZ 85034

(602) 275-0073

[email protected]

Hours: Open daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| 2010-2030 | 25% with a maximum amount of $1,000 | Individuals who install equipment from December 2010 to December 2021 |

| 1997- | 100% of sales tax- passive | Individuals who purchase solar energy devices and its installation |

| 2006- | 100% property tax exemption- passive | Individuals who install equipment during the tax year |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Arizona Public Service

Renewable Energy Standard and Tariff

Solar Design Standards for State Buildings

Billing & Payment Programs

Energy-Saving Tips

Clean Energy

Contact

Online Account Management

Power Outage Map

Arizona Department of Environmental Quality

ADEQ Phoenix Office

Suite #160

1110 W. Washington St.

Phoenix, AZ 85007

Phone: (602) 771-2300

Toll-Free: (800) 234-5677

Monday – Friday

9:00am – 5:00pm, subject to change

ADEQ Tucson Office

Southern Regional Office (SRO)

Suite #433

400 W. Congress St.

Tucson, AZ 85701

Phone: (520) 628-6733

Toll-Free: (888) 271-9302

Monday – Friday

9:00am – 5:00pm, subject to change

Understanding Arizona Solar Incentives and Renewable Energy Options

Thanks to Arizona solar incentives, this state may be one of the best places for for taxpayers who want green electricity, particularly solar power, and there are many reasons for this.

With more than 300 sunny days all through the year, solar energy is an option that anyone in Arizona can take advantage of to reduce their energy dependence, costs, and emissions.

That’s not even the only reason why solar panel energy is booming in Arizona. Did you know that there exists the statewide Arizona solar tax credit program?

In addition to the federal solar tax credit that is available at 30%, anyone can enroll in Arizona’s solar incentives, lowering their energy costs.

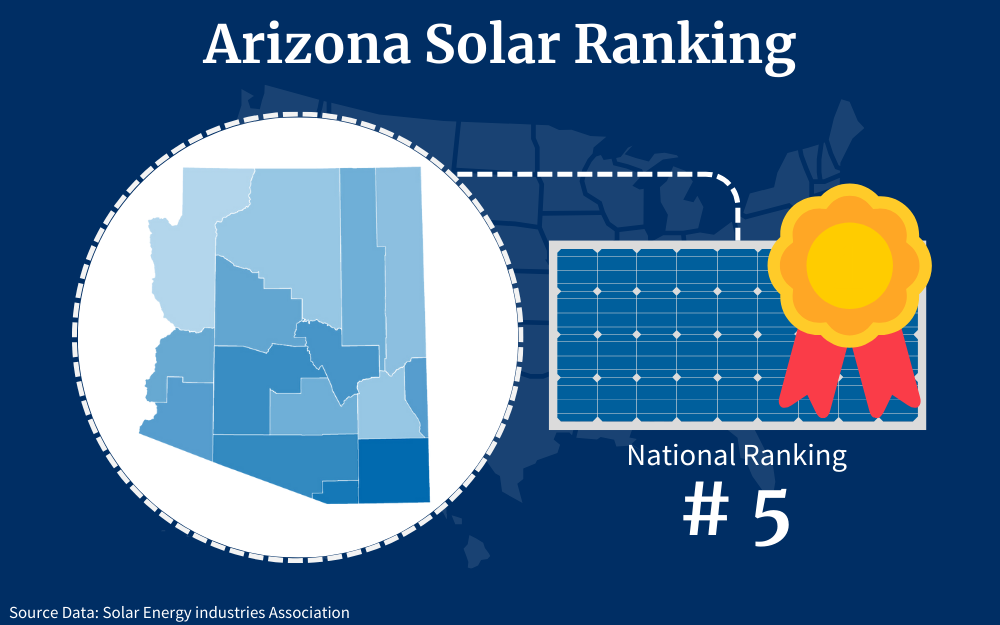

This state is making sure that solar power is available to residents, and this guide explains exactly how Arizona solar incentives have made it possible for the state to rise to the top 5 of the best states to go solar, and how you can register for yours.

In Arizona, a large portion of the renewable energy generated is from solar farms, and the state currently ranks fifth in the US for solar adoption.

But, homeowners can also install solar panel systems, increasing the state’s renewable energy portfolio.

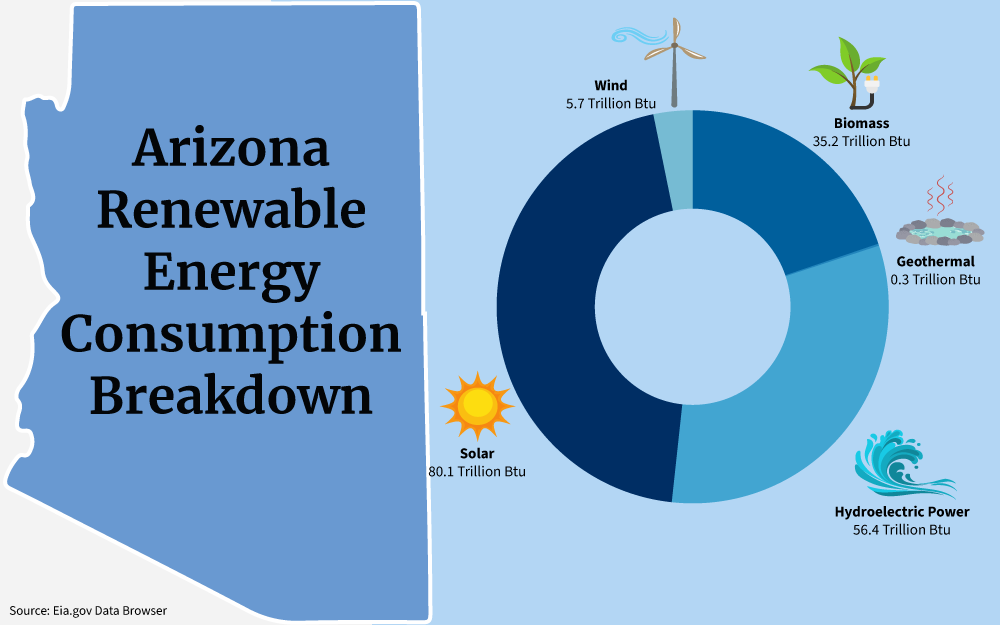

Moreover, there are a lot of incentives and rebates that both the federal and state governments offer to promote the use of renewable energy, including wind, hydroelectric, and solar power, across the U.S. and Arizona.

Solar and other renewable energy tax credits are effective ways to get more people, businesses, and power companies on board with the idea of green energy by reducing out-of-pocket expenses and are often funded by the Office of Energy Efficiency and Renewable Energy (EERE) programs.

For residents, this equates to a credit that reduces your tax liability and other programs since solar power energy is considered green.

All that you have to do is to know the eligibility criteria and how to apply for them using the solar tax credit forms in Arizona.

Federal Solar Tax Credit for Solar Photovoltaics

This is the solar tax credit that you must have already heard of. It is in operation in all 50 states and, of course, also in Arizona, and it is one of the most lucrative Arizona solar incentives.

So, how exactly does it work? And who qualifies for solar tax credit for their house solar system?

The ITC, as it is more popularly known, is a program where Arizonans are able to receive 30% of their solar panel installation cost deducted from the total amount of taxes that they owe in a particular year.5

The best thing about this system is that there is absolutely no maximum amount that you can claim, and if your tax liability doesn’t cater for all of it, the balance can always roll over to the next year, for a total of five years, for that matter.

Any tax paying resident of the state is eligible for this solar tax credit, just as long as they already have a tax liability and they are able to prove that their system is entirely under their ownership. So how do you even apply for the federal solar tax credit?7

And, what forms do I need for solar tax credit?

It takes a few simple steps, really.

- Download IRS Form 5695, which you can find on the IRS website.

- Fill it accordingly, starting with Part 1 of the file, where you will indicate exactly how much the entire project cost.

- Add other details according to the Form 5695 instructions

- File the form with your 10-40 and enter the amounts indicated on the instructions.

With the steps above, you will be done in just a few minutes.

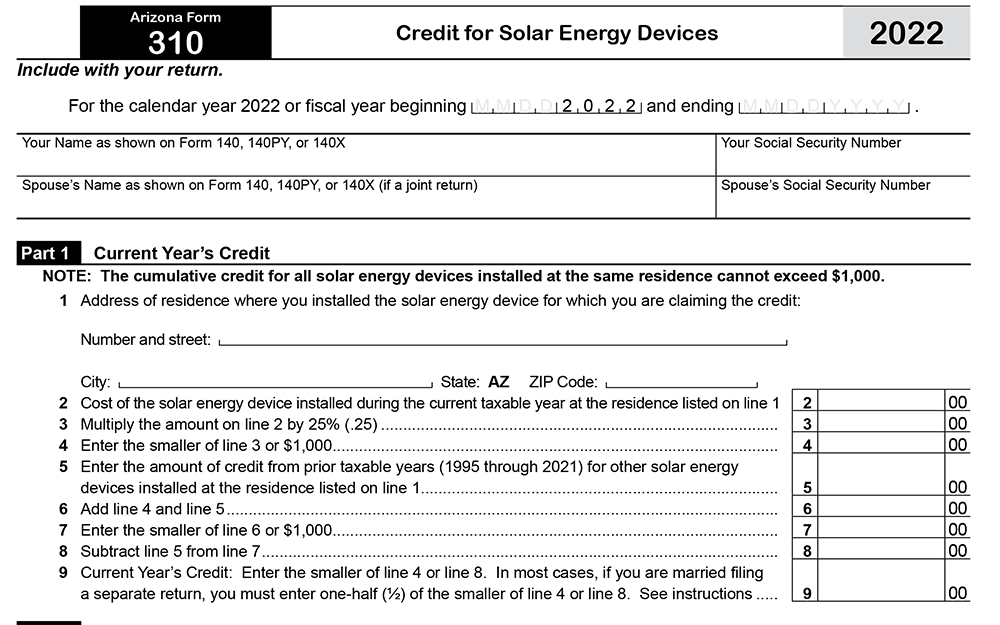

Arizona Statewide Solar Tax Credit: Enroll With Form 310

There is something special about the solar market in Arizona, the fact that there exists a statewide solar tax credit. This is not very common in many states, and it is actually one of the very few that offer an exclusive tax credit for its residents apart from the federal ITC.

Arizonans have the advantage of having an additional 25% tax credit from the state government.

However, there are a few rules when it comes to this incentive; for one, there is a maximum limit of $1,000 for the tax credit, and the limitation is that your system has got to be 5kW or larger, and the project must be on your own land. So, how to get Arizona solar tax credit as a resident is pretty simple because you can apply for it when filing your state taxes through the AZ Form 310 (Nonrefundable Individual Tax Credits and Recapture).

The very first step is to go to the website of the Arizona Department of Revenue and,8 like the federal credit, download the Arizona Form 310 (Credit for Solar Energy Devices).

If the process seems rather complicated, you can always consult a professional to handle it for you, but all in all, the Arizona tax credit is pretty simple to apply for.

The $1,000 tax relief is worth more than what most states offer, and can be combined with the federal credit.

Renewable Solar Energy Credits From the Government

The federal ITC is the most lucrative government solar panel program for Arizonans, followed by the statewide solar tax credit, but in addition to those Arizona solar incentives, residents who embrace green energy have even more options.

Below are some of the available Office of Energy Efficiency and Renewable Energy (EERE) programs for Arizonians to use when installing a home solar power system.

Enroll in the Mohave Electric Cooperative (MEC) Program

If you have a home solar system that is 50 kW or smaller, which is literally any residential or small-scale panel system, you are able to apply for the SunWatts Renewable Program,13 which usually offers about 5 cents for each and every watt of solar power produced or a maximum of $2,500.3

To obtain this credit:

Step 1. Fill out the reservation form.16

Once your reservation is approved, the enrollment packet will be sent to you. It contains all the additional forms and conditions for obtaining the funds.

Step 2. Once approved, complete the enrollment form and the interconnect form and DGS application.

Step 3. The system qualifications and final forms are also included, which are completed after the system is in place.

Step 4. Inspectors from the Co-op will inspect your home solar system and approve the funds.

The SunWatts program also has an additional rebate for solar water heaters, offering you 75 cents for every kilowatt of energy saved (during the first year of use).

Scottsdale AZ Green Building Program

The City of Scottsdale also has a perk for its residents who are involved in green building projects.14 Well, these are not really direct financial incentives, but they also go a long way to make solar power more accessible.

Thanks to such programs, you are able to receive technical assistance like system permits when making the switch to renewable energy.

APS Battery Program

This is an incentive that targets Arizonians who have bought themselves solar battery systems.

If you are one and have registered for the APS Battery Pilot,15 there is around $3,750 worth of incentives up for grabs.

How To Get Free Solar Panels From the Government

Solar energy government programs have gone to great lengths to make this renewable power more accessible, even for low-income families. But still, solar panels remain a huge investment, and you can’t help but ask, are there free solar panels in Arizona?

Unfortunately, there are currently no such programs for Arizonans, although there are two services that come really close to ‘free solar,’ and those are solar leases and PPAs (Power Purchase Agreements).

When it comes to the first program, you lease the solar system from the company. The installer literally gets every single thing done for you, and then your part is to pay a certain fixed amount of money at the end of every month.

The panels do not belong to you, but they are for the company, and technically, that means that you are not eligible for the two solar tax credit programs in Arizona. The good news is that the leasing amount is more often than not lower than the usual energy bills, which still makes it a great deal.

On the other hand, there is also the Power Purchase Agreement that you can get into,10 which usually lasts 5-20 years. Here, you sort of agree to buy the power that is generated by the solar system that is installed at a certain agreed rate for a time frame, but unlike solar leasing, there is an option of buying out the system when the contract is done.

As for both programs, the upfront materials and installation costs are mitigated, but you will not own the home solar system and will be responsible for a monthly bill.

Installing a Home Solar System in Arizona: What To Know

Installing a solar energy system in Arizona is less expensive than ever before, especially now that the cost has been on a downward trend over the years.6

As a homeowner, you will more than likely part with anything around $23,000. That is for a typical 9-kW system. Of course, there are certain factors that will come into play to determine the figure, so that is not a fixed value.

You may even end up paying less for your system under certain conditions. Perhaps you have lower energy needs and need a smaller solar system than the 9kW one? The costs will reflect the size of your need.

The size of your house will also make all the more difference. For instance, how much do solar panels cost for a 1,500-square-foot house?

Using home square footage to measure your energy requirements isn’t the best method. The best measurement is based on your current electricity use.

Once you know the size of the system you need, you’ll also need to purchase materials, including:

- Controller

- Inverter

- Battery (Storage)

- Cables

If you make full use of the solar incentives in Arizona, from the state to the federal solar tax credits, you may actually spend way less than you thought.

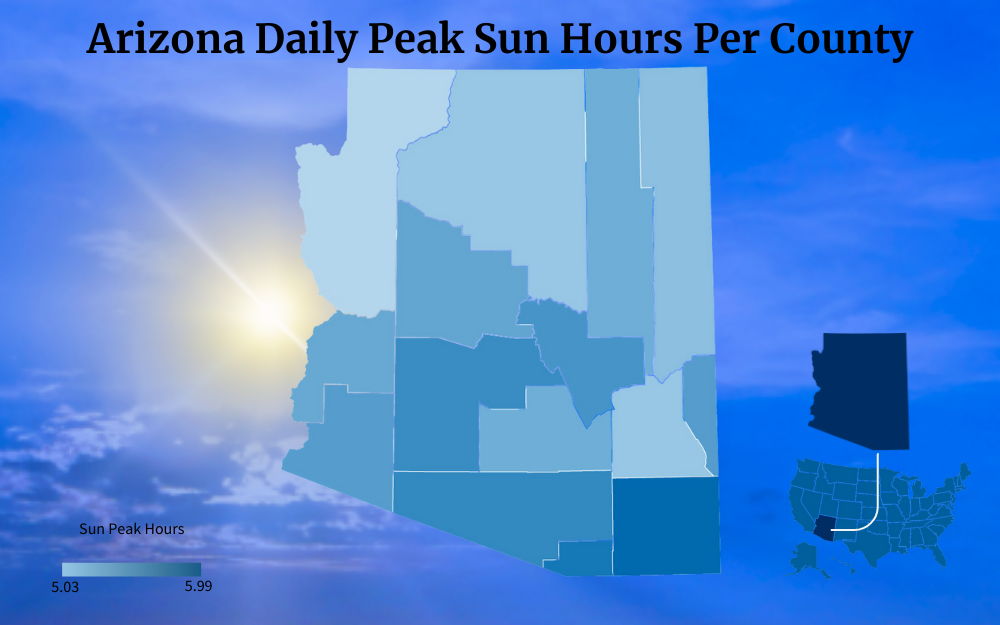

How To Calculate How Many Solar Panels You Need: AZ Daily Sunlight Hours

Looking at the cost of solar systems,9 there is no doubt that the panels are some of the most expensive pieces of equipment in the entire solar module.

In general, an average home in the US will require about 15-20 panels in order to satisfy all its energy needs. However, this rate tends to vary based on many factors.

To determine the number of photovoltaic solar panels that you need, you will have to take into account the following:

- What is the size and angle of your roof

- What is the pitch and location of your roof (or do you plan to install the panels on the ground)

- How much energy do you normally use

- Where exactly do you live (to estimate the total hours of sunlight in a day).

So, to determine how many panels a house is going to need, the following equation is normally used.

(The total energy consumption of the house in kWh divided by the peak sunlight hours) and the results will be later divided by the wattage that comes from each panel.

On the other hand, when it comes to the total amount of power that comes from the said panels, again, there are some factors to take into account.

For instance, you will have to consider how much sunlight the panels are exposed to (which should not be a problem when living in Arizona), how efficient the other panels and other parts are, and the ambient temperatures.

But still, regardless of these conditions, a typical solar panel has an output rating of anything between 250-400W, and as for the daily energy output, you can expect about 1.5 kWh.1

How To Find AZ Solar Panels

Whether you are buying brand-new PV modules or used solar panels, you want a system that is durable and one that will be able to do a great job. When considering used panels, ask how long the solar panels will last.

Most newer versions have a lifespan of 25-30 years with proper maintenance, after that, you’ll need to understand the correct solar panel disposal method for your location.

It all starts with picking the right Arizona solar company for your power solar home, and if you don’t know where you are supposed to start, maybe the following tips will help.

Find All the Services in One Place

It is pretty understandable that the process of finding just one company from the several that are operating in Arizona can be overwhelming.

Not sure where to buy solar panels and other equipment and don’t know who will have them installed? Look for a company that offers experience and a total package.

Make Sure That the Company Is Accredited

Buying solar panels in Arizona for the first time? You will have to go for a company that has the right accreditation, which proves that it has all that it takes to get the job done.2

You can always do a background check to make sure and also request if they have a method for the disposal of solar panels.

Company Reputation Matters

Imagine a company that has been in the game for years. Also, think about a company whose customers keep lauding it for its great products and services; that is definitely who you want to work with.

This must be a very careful decision, especially if you take into consideration how long solar panels last in Arizona.

Payment Flexibility

Companies are also aware that the installation of solar panels is a massive project that tends to cost quite a lot of money.

That is why you need to find a company that has the most flexible payment plan, maybe loan financing options, or one that has favorable solar leasing or PPA contracts.

Lifespan and Benefits of Solar Panels in Arizona

Solar panel degradation usually begins from 20-30 years, based on their type and the maintenance you perform. But, they can provide a host of benefits.

In addition to becoming independent from the grid, you’ll also significantly reduce your homes carbon footprint. And, depending on the age of the system, you may increase the value of your home.

For each and every dollar reduced in your electricity bill, you are likely to increase the value of your Arizona home by $20.

The rate is currently at 4%, which is a great boost if you have any future plans of reselling.

Expect 25-30 years in total (if the panels are regularly cleaned), and that basically means that you will enjoy free power for a long time, way after the panels have paid themselves off and until their end of life.11

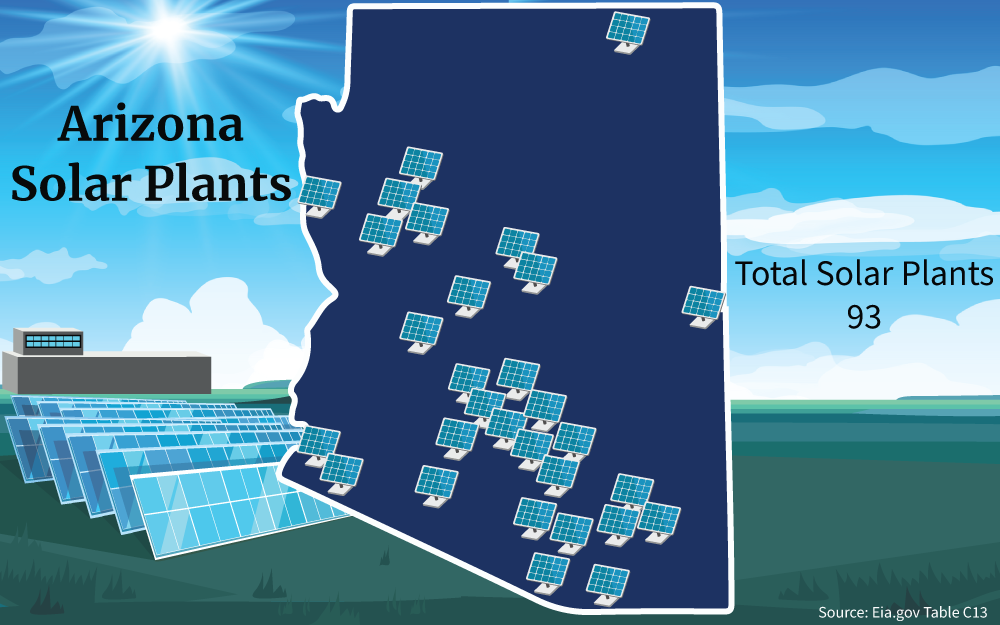

Current Solar Farms and Solar Plants in Arizona

The Solar Energy Industries Association reports the power that comes from solar in Arizona is enough for over 900,000 homes all across the state.12

In addition to that, there are also so many installations that have come up in recent years, some of them featured in the list of the most massive in the entire country.

For instance, there is the 398 MW Sunstreams project in Hassayampa, and the 135 MW installation called the Saint Solar present in Coolidge. These projects are responsible for powering tens of thousands of homes, but the solar power plans and projections state that Arizona could reach a 10,000 MW capacity in a few years.

The reasons why the solar market is booming in the state are because of the high sunshine levels, the many Arizona solar rebates, the low cost of installing solar panels, and the few years of payback period.

Solar energy facts show that it will take only about six years and a half for you to get your money back after installing solar panels in Arizona, and what that basically means is that you will be able to get free electricity for as long as 18 years, that is if they will last the full 25-year lifespan.

Arizona Energy Costs

Arizonans are able to save thousands in the process by making the switch to solar power. The payback period may even decrease if you register for net metering, which is a way of selling solar power to generate income; you will be able to receive credits that will save you a great deal as well.

Utility companies usually pay anything between 7.81-10.45 cents for every kWh generated by your panels.4

What are you waiting for? If you live in Arizona and still haven’t made the switch to solar power, you are really missing out on the state’s most prized natural resource, the abundance of sunlight.

Arizona boasts of some of the sunniest days, and you can turn that into an investment by harnessing solar power.

This explains why the solar market is on an upward trend and why more and more people are disconnecting from the grid and focusing on power from their own panels.

With the federal tax credit and many enrollment programs and rebates, Arizona solar incentives make moving to solar energy both attractive and feasible.

Frequently Asked Questions About Arizona Solar Incentives

Is There a Statewide Solar Tax Credit in Arizona?

Only a few states offer state-level solar tax credits on top of the federal one, and in this case, Arizona is one of those places. The state government offers tax relief set at 25% (capped at $1,000) of your total installation cost as a reward for going solar; this, however, is still significant savings especially when added with the federal solar tax credit.

Can You Get Free Solar in Arizona?

Unfortunately, the concept of free solar panels is not very realistic, especially not in Arizona. Instead of free solar panels, what is available to you as a resident is solar leasing and PPAs, which help you have the solar system installed at very little or no cost.

Is Solar Power Worth It in Arizona?

There are so many reasons that back up why the use of solar power in Arizona is worthwhile, including its thriving solar market driven by abundant sunlight and numerous available incentives. In the long run, you will also realize that the payback period of the panels is way shorter, which makes investing in solar power all the more worth it.

References

1David, L. (2023, August 10). How Much Power Does A Solar Panel Produce? (2023). MarketWatch. Retrieved August 23, 2023, from <https://www.marketwatch.com/guides/home-improvement/power-solar-panels-produce/>

2Sunsolar Solutions. (2023, June 19). 5 Tips for Finding the Best Solar Company. Sunsolar Solutions. Retrieved August 23, 2023, from <https://sunsolarsolutions.com/5-tips-for-finding-the-best-solar-installation-company-in-Arizona/>

3Simms, D. (2023, August 16). Arizona Solar Incentives (2023 Tax Credits & Rebates). Today’s Homeowner. Retrieved August 23, 2023, from <https://todayshomeowner.com/solar/guides/Arizona-solar-incentives/>

4Wakefield, F. (2023, August 10). Arizona Solar Tax Credits, Incentives and Rebates (August 2023). MarketWatch. Retrieved August 23, 2023, from <https://www.marketwatch.com/guides/home-improvement/Arizona-solar-incentives/>

5Zagame, K. (2023, August 5). 2023 Arizona Solar Incentives Guide (Tax Credits, Rebates & More). EcoWatch. Retrieved August 23, 2023, from <https://www.ecowatch.com/solar/incentives/az>

6Mey, A. (2021, July 16). Average U.S. construction costs for solar generation continued to fall in 2019. U.S. Energy Information Administration. Retrieved September 1, 2023, from <https://www.eia.gov/todayinenergy/detail.php?id=48736>

7Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy Efficiency & Renewable Energy. Retrieved September 1, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

8Arizona Department of Revenue. (2023). Arizona Department of Revenue Homepage. Arizona Department of Revenue. Retrieved September 1, 2023, from <https://azdor.gov/>

9Roberts, M. (2014, April 7). The Costs and Benefits of Installing Solar PV. UHERO. Retrieved September 1, 2023, from <https://uhero.hawaii.edu/the-costs-and-benefits-of-installing-solar-pv/>

10Shah, C. (2011, February). Program Name or Ancillary Text eere.energy.gov Power Purchase Agreements. eere.energy.gov. Retrieved September 1, 2023, from <https://cybercemetery.unt.edu/archive/oilspill/20120916152847/http://www1.eere.energy.gov/femp/pdfs/afo_ppa_pres.pdf>

11United States Environmental Protection Agency. (2023, August 17). End-of-Life Solar Panels: Regulations and Management. United States Environmental Protection Agency. Retrieved September 1, 2023, from <https://www.epa.gov/hw/end-life-solar-panels-regulations-and-management>

12Solar Energy Industries Association. (2023). Arizona Solar. SEIA. Retrieved September 10, 2023, from <https://www.seia.org/state-solar-policy/arizona-solar>

13Mohave Electric Cooperative. (2023). Renewable Energy. Mohave Electric Cooperative. Retrieved September 13, 2023, from <https://www.mohaveelectric.com/energy-solutions/renewable-energy/>

14City of Scottsdale. (2023). Green Building Program. City of Scottsdale. Retrieved September 13, 2023, from <https://www.scottsdaleaz.gov/green-building-program>

15Arizona Public Service. (2023). APS Homepage. APS. Retrieved September 13, 2023, from <https://www.aps.com/en/residential/home>

16Mohave Electric Cooperative. (2023). RENEWABLE ENERGY INCENTIVE TARIFF (REST) Uniform Credit Purchase Program Application. Sunwatts Mohave Program. Retrieved September 13, 2023, from <https://www.mohaveelectric.com/wp-content/uploads/Reservation-Form-2022-r.pdf>

17Screenshot of Arizona Form 310. Arizona Department of Revenue. Retrieved from <https://azdor.gov/sites/default/files/2023-03/FORMS_CREDIT_2022_310_f.pdf>